Brexit is the currently trending everywhere. There seems to be panic everywhere on the impact of ‘Brexit’ on the world economy. Britain is going to exit the European Union, and there is news of other countries within the EU also looking at similar referendums. There is worry about how this will impact the global economy as the world has become increasingly interdependent over the years.

Let us look at how it is likely to impact you as an individual.

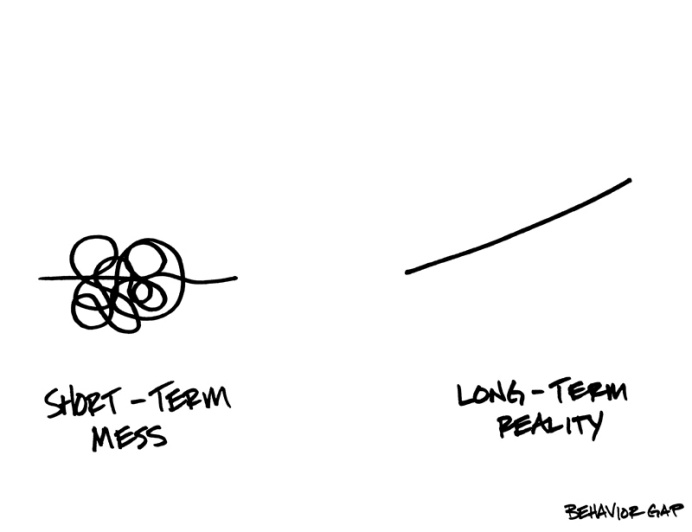

Firstly, you need to understand such events keep on happening in the economy only the scale is different. Two of the events in recent memory are the crash after 9/11, then the Lehman crisis. It seemed like doom then but eventually the economies did get back. It is not all rosy all the time, there are phases which are bad and they do impact us in one way or the other. We have no control over these events. What is more important is our reaction to all these events as an individual.

Image Credit: Carl Richards

When will you get badly impacted?

- If you are leveraged i.e. have invested on borrowed money.

- If you are more of a trader than an investor.

- If you have invested without understanding your own risk profile and the risk of the product.

- If you have invested without any goal.

When will the impact be muted?

- When you have an investor mindset

- If you understand your own temperament as well as the risk of the product.

- If you have invested as per a plan.

- If you have an advisor who can hand hold you during such crisis.

Why will the impact be muted in the cases as mentioned above?

- When you have an investor mindset, you look at buying good businesses. Businesses do not make money in a day. Good businesses grow over a period of time, have good strategies to overcome such hurdles, have integrity and provide something valuable to the people.

Hence even in times of such crisis, you will tend to stay invested rather than panic and sell off. Over a long period of time you will have the gumption to invest in such markets which will come naturally to you. - If you understand your own temperament well, you will know how you will react to certain situations. If volatility makes you nervous, you would either avoid it or know how to handle it if you have to face it.

Based on knowing yourself, you will also look at products that suit your risk profile. - If investments have been chosen taking into consideration your risk profile, your goals and your life situation, it is less likely that you will face too much nervousness in such scenarios.

- If at all there is nervousness, you can always go back to your advisor who will help you overcome your nervousness by going through your plan and re-checking your shock absorption strategies.

As advisors, while creating portfolios, we take into account your personal situation. There are strategies built around protecting you in bad times. One of the obvious things that will protect you is your asset allocation. If you have invested in various asset classes the impact will naturally be reduced rather than being in a single asset class. There is something known as correlation among asset classes. This basically means how will one asset class react, to a particular event, in relation to the other asset class. While an ideal portfolio should be built with negatively correlated asset classes, it is practically not possible as there is no truly perfect negative correlation available. In simple English, this means that there are no asset classes which will move totally in the opposite direction as compared to another asset class. Say for example equity crashes, this does not mean that bonds/commodities/currency will rally. They might fall to a lower extent, or at certain time move slightly up. If you have appropriate allocations to suit your profile, the impact on your portfolio will be muted.

Young investors: You are having income from employment-either salary or business/professional income, so you are not dependent on your investments for daily living. You are still far away your goals like retirement or funding kids education. For you, it is an excellent opportunity to invest more into equity. The equity market may fall further on other global bad news, but if your goals are more than 10 years away, these risks are negated. What you need to watch out for is the impact on your job/profession. If your industry is going to be impacted, you should buffer up your resources to face a scenario of lay-off or no increments in the coming years. If there is enough buffer available (upto 12 months of expense) you can go ahead and invest in equity.

Pre-retirees: If you have not reduced your exposure to equity yet, in the run up to retirement, you should ideally wait out this period rather than panicking and exiting now. You should never be zero in equity even in retirement, so holding on is a better option. You might want to start taking stock of how much income will you require in retirement and talk to your advisor to draw up strategies for generating income accordingly.

Pre-retirees: If you have not reduced your exposure to equity yet, in the run up to retirement, you should ideally wait out this period rather than panicking and exiting now. You should never be zero in equity even in retirement, so holding on is a better option. You might want to start taking stock of how much income will you require in retirement and talk to your advisor to draw up strategies for generating income accordingly.

Retirees: Ideally you should have built your portfolio to have part guaranteed income and part income to be generated from non-guaranteed products. If you have built a portfolio with a proper asset allocation, you will be fine during this period. Most likely your equity portion will not need to be touched over a longish period of time and will have time to recover from these short term shocks. Your monthly/quarterly reports will show losses, but you need to stay invested to let the portfolio recover over a period of time. Withdrawing now will mean booking the losses, which might not be good on a long term basis.