It is that time of the year again when we get inundated with sales and offers from online and offline stores. It is indeed very tempting to spend money on the variety of things that are show cased so attractively, be it garments or gadgets, fashion or furniture! To add to the lure now we are seeing the Zero interest EMI schemes back in vogue in many offline and online stores. Are these schemes genuine or do you end up paying more?

Background:

As a background it is important to know that The Reserve Bank of India had banned zero cost EMI schemes in 2013. To understand the reason behind that ban, we will need to know how these schemes worked then.

For simplicity let us imagine you were buying a product worth Rs.10,000 on a 6 month EMI. So if it was a zero cost EMI, it would mean you pay 6 instalments of Rs.1667 each. But then no one makes any money on this. So what was the catch? It was the processing charge. If you were to pay a processing charge of Rs.500 upfront on this transaction, you effectively paid an interest of 11% on the transaction.

In this case, there were two issues. First, there was no transparency. The customer was being charged interest which was being labelled as processing fee. Second, the processing fee could not be very low as the bank was not allowed to lend below the base rate. Besides, it would not be viable for the bank to lend at a lower rate as the cost at which it was getting funds from the market (the fixed deposit rates that it offers to customers) was high.

To fix these issues, RBI banned zero interest schemes. But unfortunately NBFC were out of purview of this ban, so some schemes still continued.

What has changed now?

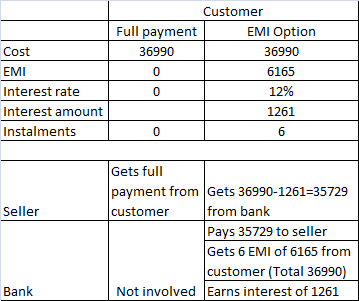

In its new avatar, the zero interest schemes are back with superficial changes. There is a tie-up between the manufacturers/retailers and the bank. The interest charged by the bank is paid back to the customer in form of the discount borne by the manufacturer/retailer. The invoice will show a bank interest and a discount to be identical. Let us understand with an example. A popular smart-phone on one of the ecommerce sites is available for Rs.36990.

So this is actually a zero interest EMI, it is also not flouting the RBI guidelines.

So this is actually a zero interest EMI, it is also not flouting the RBI guidelines.

Look at the flipside. Normally when you pay upfront for any purchase you get a discount, while anything on credit entails a charge. These schemes are actually doing the reverse. They are benefitting the guy who takes credit and not giving any benefit to the one who makes upfront payment.

This is to entice customers to buy more than they need.

If you decide to opt for the zero cost EMI option, pay attention to the following:

Read the fine print. It is zero cost EMI only if there is no processing fee or any other such head in which you are being charged anything extra.

- The zero cost EMI is available for select products and select tenures only. So be careful, you might be offered a slow moving product.

- If you return the product, you will not get back the interest portion that has already been charged on the EMI. In addition bank might levy charges for pre-closure penalty/other charges.

- In offline sale in addition to an upfront payment of some instalments (usually 3) EMI, there might be requirement of paperwork like you salary slip and KYC etc.

- If you are unable to pay the EMI at a later date, the credit card charges 36-48% will be very heavy to bear.

- Non- payment of EMI/ outstanding on your credit card will result in negative impact on your credit rating. This will impact your future loan eligibility/rates.

- You are spending your future income today in form of EMI for consumer goods which is a depreciating asset. This is not a good financial practice.

- You might end up overspending due to the ease of small payments. You may be buying things that you don’t need because you don’t need to pay today.

From the financial planning perspective, it is better if you plan major expenses and save for it, rather than looking for credit (loan/EMI) for consumer goods. However, if there is a genuine requirement, the zero cost EMI option can be utilized with the points mentioned above in mind.